The insurance companies that don’t go mobile now risk becoming invisible tomorrow: over 50% of insurance searches are performed on mobile devices. The digital shift is reshaping how customers choose, buy, and manage insurance, and it’s happening fast.

Insurance is no longer sold face-to-face. Today, it occurs in seconds – right on a customer’s smartphone screen. In a market where convenience and speed are everything, owning that screen means owning the client’s attention and, ultimately, their loyalty.

Why insurance companies should invest in insurance app development

The insurance game is changing fast, and customers won’t wait around. They want quick, simple digital tools that just work. Most leaders get that apps matter, but too many stumble when it comes to making them actually deliver.

A well-designed and flawlessly executed insurance mobile app development is your chance – nail it and take the lead while others fall behind. The following stats clearly show why.

The InsurTech market size is projected to grow from $1.19T in 2025 to $2.19T by 2030.

This explosive growth reflects how quickly the industry is transforming. Customer demand for digital experiences, combined with the rise of agile InsurTech startups, is forcing traditional players to adapt – or risk losing relevance.

Note: Investing now positions you to capture a significant share of this booming market before it becomes saturated.

78% of Gen Z and Millennial customers expect digital insurance across all platforms.

People are done with waiting on hold or dealing with endless forms. They expect the same fast, intuitive experience from their insurer that they get from banking, shopping, or ordering a taxi – right from their smartphone, anytime.

Note: Developing an insurance mobile app helps you stay competitive and avoid losing customers turning to more nimble, tech-savvy newcomers.

Digital transformation and tools can cut insurance operational costs by 65%.

With the insurance app, routine tasks like claims, document collection, and policy updates run automatically. You cut manual workload, avoid bottlenecks, and free teams to focus on tasks that actually grow the business – not on chasing paperwork.

Note: A mobile app can save you time, money, and resources by removing manual work and preventing wasted effort on low-value operations.

61% of insurance leaders report resource constraints limiting mobile app adoption.

Nearly all – 99% – recognize mobile apps play an essential role in boosting customer engagement. However, many still encounter digital transformation challenges caused by resource constraints, and that’s where your competitive advantage comes in.

Note: High demand doesn’t mean the market is fully captured – it means the market is hungry for solutions that are done right.

69% of customers who download their insurance provider’s app use it at least monthly.

The retention gap between digital leaders and laggards is quite obvious. Companies that delay insurance app development aren’t just missing opportunities: they’re actively losing ground to have many more touchpoints with their audience that's immersed in mobile.

Note: An insurance mobile application is your opportunity to build strong customer loyalty and unlock wide opportunities for cross-selling and upselling.

Types of insurance apps

Insurance apps cover a wide range of needs: each type solves different tasks: managing policies, processing claims, tracking coverage, or accessing support. Let’s explore how these apps work, what features they offer, and why they’ve become essential for both users and insurance providers.

Life insurance app

Life insurance apps revolutionize how people approach financial security for their families. They provide personalized plan comparisons, instant digital policy updates, and real-time beneficiary management – all in one place. These apps remove traditional friction points like long paperwork and agent meetings, making operational overhead lower and sales cycles faster.

Example: Ladder

Health insurance app

Designed to put healthcare control into users’hands, they combine claim submissions, appointment scheduling, and benefit tracking into seamless workflows. By offering integrated telehealth features and transparent cost estimations, these apps reduce confusion and speed up access to care. The outcome – higher retention and optimized service delivery.

Example: Oscar Health

Property insurance app

Property insurance apps simplify safeguarding homes and valuables through fast quote generation, instant damage reporting via photos or video, and quick claim approvals. They transform the traditionally slow process into a smooth experience, helping policyholders manage risks without delays. This convenience increases customer satisfaction during stressful times.

Example: Lemonade

Vehicles insurance app

Vehicle insurance mobile applications empower drivers by delivering instant digital insurance cards, automated claim filing, and easy access to roadside assistance. Many use driving data analytics to tailor pricing and incentivize safe habits. These apps eliminate the usual headaches of auto insurance by offering clarity, speed – a win for users, which means a win for insurers.

Example: Progressive

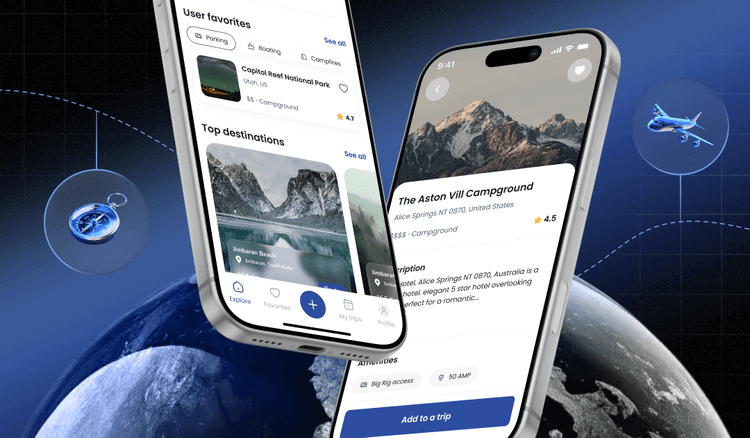

Travel insurance app

Built for on-the-go protection, travel insurance apps enabling instant policy purchases, emergency support, and easy claims submission anywhere worldwide. Features like itinerary syncing, real-time alerts, and medical referrals abroad create a safety net that adapts to unpredictable travel challenges. When paired with an AI travel app, travelers also gain personalized recommendations, language support, and dynamic rebooking options, making the entire journey smarter and more secure.

Example: Travelex

Business insurance app

Business insurance apps streamline how companies manage risk by providing customizable quotes, digital policy documents, and efficient claims processes tailored for small to medium enterprises. They deliver risk insights and compliance tracking, which is essential for reducing administrative overhead in the SMB insurance sector.

Example: Chubb

Insurance app development [key features]

“The real challenge isn’t adding more features – it’s building the right ones. Insurance application development is a niche that must strike the perfect balance between compliance-heavy processes and seamless digital experiences.

If you don’t solve that – you’re just replacing paperwork with digital clutter.”

– Natalia Ivleva, Lead BA at SolveIt

We covered the main types of insurance apps and, not without reason, touched on features tailored to the specifics of each solution. These are functionalities designed for a particular use case, meaning they won’t necessarily appear in other insurance products.

Now, let’s focus on the must-have, non-negotiable features that are critical for any insurance mobile application, regardless of its type, excluding basics like login, user profiles, or standard navigation, which are given by default.

Real-time quotes and policy management

Make buying insurance as effortless as ordering pizza. Let users compare plans, get quotes, purchase, update, or renew policies in a few taps on their own terms – no agents, no hold music, no paperwork. Transparency and control are the key.

Full control over policies builds trust and reduces customer churn. Meanwhile, your ops team breathes easier.

Effective claims filing

A broken pipe shouldn’t come with broken processes. A claims feature lets users submit photos, videos, geolocation, documents in minutes. No need to worry about compressing a video or scanning a PDF – the app handles it smoothly – cutting downtime and speeding up resolutions.

Faster claims approval boosts retention and slashes service costs. Customers stay because you make bad days less painful.

In-app payments, billing, and renewals

Seamless payments inside the insurance app eliminate missed deadlines and late fees. Customers can view bills, set up auto-renewals, and manage payments with ease. This reduces overdue accounts and fewer calls to support.

For you it means reliable cash flow and fewer disruptions. Convenience here directly impacts churn rate and keeps customers coming back.

Instant verification

For certain insurance apps, this feature is critical – when clients are stressed, injured, or vulnerable, making them repeat coverage details is the last thing anyone needs. QR codes, scannable IDs, or secure credentials with offline access allow verification of the user’s identity.

Streamlined verification ensures clients get help faster when it matters most, reinforcing your brand reliability.

24/7 support with chatbots and real humans

Give users answers now – not tomorrow. Chatbot development covers common questions, claims guidance, and account info instantly. For complex cases, real agents step in – because no matter what, a personalized human touch always beats explaining your issue to a robot.

This hybrid support reduces tickets, cuts expenses, and keeps your clients happy without burning out your team.

Push notifications that actually matter

A smart, well-thought notification system reminds users about renewals, claim updates, or urgent risks (like incoming adverse natural events, etc.), helping them stay proactive, avoid financial & time losses, and make timely decisions.

It’s your cheapest, most effective way to drive retention, boost engagement, and show customers you’ve got their back.

Document storage done right

A secure document hub keeps every important file – from claims and billing documents – easily accessible and shareable in one place, with the ability to edit PDFs directly so updates, annotations, and corrections can be made without creating new versions or lengthy back-and-forth. This У eliminates issues like lost policies, missing receipts and medical or legal conclusions, or endless email threads.

For your business, it means less load on call centers, full traceability of client interactions, and fewer frustrated users.

Security and compliance

You’re handling sensitive data – medical, financial, legal, and underwriting – which demands bulletproof protection. This means end-to-end encryption, secure logins, biometrics, compliance with GDPR, HIPAA, CCPA, plus regular audits and strict access controls. For US insurers, partnering with a reliable US healthcare cloud infrastructure option helps keep that sensitive policy and claims data on platforms built around HIPAA-aligned safeguards. In insurance, airtight security is the difference between trust earned and trust lost – no shortcuts allowed.

Insurance mobile app development in 6 steps

Step 1 – Research and discovery

Successful insurance application development starts long before the first line of code. It begins with deep research into your insurance products, user behavior, market specifics, and legal compliance. Whether it's health, vehicle, travel, or life insurance, each model requires its own approach to UX, workflows, and data protection.

Expert advice: When building an insurance app, neglecting compliance early on leads to 5-10x higher costs during release. Bring compliance into the discovery phase from day one.

Step 2 – Product architecture and system integrations

The architecture should be flexible enough to adapt, because regulations change, products evolve, and customer expectations never stand still. APIs are mission-critical – your app must seamlessly connect to payment systems, medical networks, repair shops, and legal databases. Failures in third-party integrations often lead to broken user experiences.

Expert advice: Many of the post-launch failures in insurance mobile app development come from neglected third-party APIs. Audit external partner readiness during architecture planning.

Step 3 – UX/UI design

UX in insurance app development is about removing complexity when it matters most. Users will interact with your app in high-stress, high-stakes situations, which leaves no room for confusion or friction: remember, sales are one-time – service is forever. UI design supports it with intuitive layouts, visual clarity, and minimal cognitive load.

Expert advice: Prioritize prototyping for service flows – this catches critical UX gaps early and saves you from costly redesigns later.

Step 4 – Actual development

Insurance application development is a deeply regulated, data-heavy, security-critical process. At this stage, technical debt hidden in shortcuts isn’t an option. Such apps live for years, with constant product changes, compliance updates, and integrations. If the codebase isn't modular and clean, every small update turns into an expensive nightmare.

Expert advice: Even when developing an MVP, prioritize scalability from the start. Building a flexible foundation guarantees avoiding expensive rewrites as your insurance app grows.

Step 5 – QA and compliance validation

Testing for insurance apps means more than functional bug checks. It requires stress-testing against disaster scenarios (claim surges, data breaches), verifying compliance with GDPR, HIPAA, CCPA, and PCI DSS, and ensuring every data point flows securely through APIs and storage.

Expert advice: If you underinvest at this step, your support costs will skyrocket post-launch, so make sure to include testing in the initial budget.

How much does it cost to develop an app?

Read articleStep 6 – Launch & monitoring

Be ready for strict reviews from the app stores side and potential delays, especially around handling sensitive user data. Monitoring focuses on sharpening every touchpoint to deliver clear value. In insurance, rapid adaptation powered by data-driven improvements becomes a decisive competitive edge.

Expert advice: Rely on analytics data and users’ insights to prioritize features for the next development phases in case you’re building an MVP.

If you're planning to build an insurance app that checks all the boxes of these steps – from compliance and UX to integrations and scalability – your best bet is a one-stop development partner.

Looking for a full-cycle development partner? Let’s talk!

Contact usInsurance app development cost

Insurance mobile app development is a strategic investment. Whether you're a legacy carrier modernizing operations or an insurance tech startup entering a regulated market, the bar for usability, compliance, and performance is high from day one.

How long does it take to develop an app?

Read articleMVP insurance app

For early-stage teams or idea validation, MVP insurance app development helps bring a focused version of the app to market faster. But in the insurance industry, even MVPs need to support secure onboarding, essential workflows like quoting or claims, and meet basic compliance requirements.

💰 Estimated cost: $35,000 – $60,000

Basic insurance app

This level works for funded startups or insurers aiming to digitize key touchpoints. You can expect more features (e.g., self-service, claim history, notifications), better UX, and integrations with internal systems like payment providers or CRMs. It's a practical foundation to iterate on.

💰 Estimated cost: $60,000 – $150,000

Advanced / AI-powered insurance app

For founders investing in long-term differentiation, advanced apps combine end-to-end policy management with machine learning, dynamic pricing, fraud detection, or smart underwriting. These solutions require scalable backend architecture, airtight security, and full regulatory alignment from the very start.

💰 Estimated cost: $150,000 – $500,000+

“An insurance app development itself is not the final line item in your budget. Long-term success requires ongoing investment in infrastructure, scalability, compliance, and user engagement.

Cutting corners upfront often results in higher costs down the road.”

– Natalia Ivleva, Lead Business Analyst at SolveIt

Here are key cost factors beyond initial development:

-

Cloud infrastructure & hosting. Secure, scalable hosting (e.g., AWS, Azure) ensures uptime and performance. Pricing depends on storage, traffic, and region.

-

Third-party integrations. APIs for payments, ID verification, KYC/AML, or claims automation often carry licensing or usage-based fees.

-

Scalability & load handling. Building for future growth means allocating a budget for load testing, modular architecture, and elastic infrastructure.

-

AI & automation features. Suspicious activity identification, claims triage, and smart notifications powered by ML can streamline ops but require upfront investment.

-

Legal & compliance consulting. Ensuring GDPR, HIPAA, or PCI DSS compliance requires legal review, documentation, and ongoing audits.

-

Marketing & user acquisition. Budget for app store optimization, paid ads, PR, and referral programs to drive installs and retention.

Final word

Starting from insurance app development scratch or moving a running business through a digital transformation, success hinges on execution – that’s what separates a good product from a great one.

At SolveIt, we offer scalable, user-focused mobile app development services at competitive market prices, delivering products that exceed customer expectations and drive business success. Reach out to our team to get started.